Tennessee Tax Sale Redemption Period . Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. the presumption of abandonment shall not arise until the final determination of all filed motions for. once the period of delinquency is established, the redemption period shall be set on the following scale: to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. Owners must either redeem the property.

from www.nashvillescene.com

after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. the presumption of abandonment shall not arise until the final determination of all filed motions for. Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. once the period of delinquency is established, the redemption period shall be set on the following scale: Owners must either redeem the property. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days.

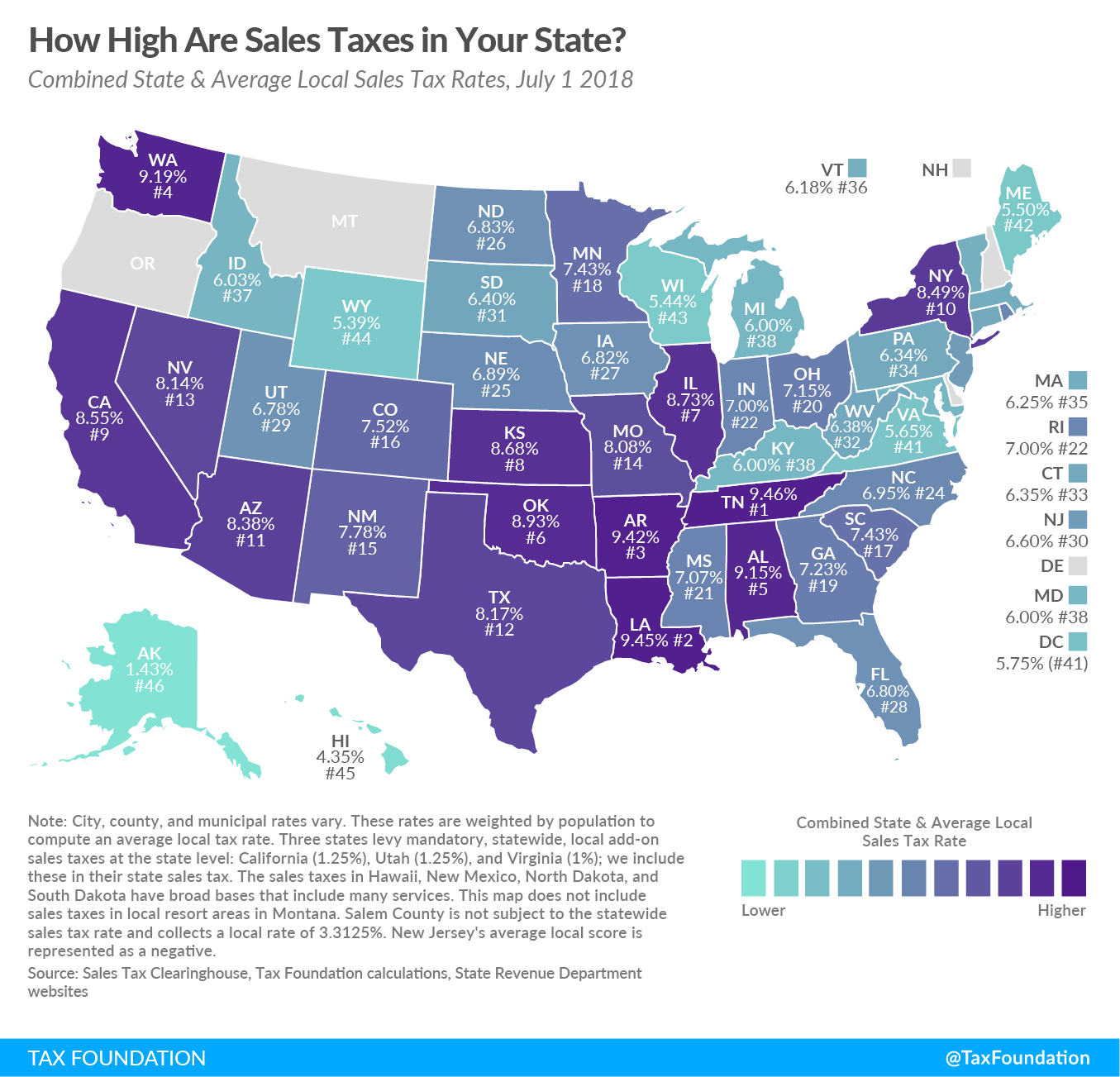

Tennessee Now Has the Highest Sales Tax in the Country Pith in the

Tennessee Tax Sale Redemption Period for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. Owners must either redeem the property. once the period of delinquency is established, the redemption period shall be set on the following scale: the presumption of abandonment shall not arise until the final determination of all filed motions for. Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days.

From forixcommerce.com

What You Need to Know About Tennessee Online Sales Tax Rules Tennessee Tax Sale Redemption Period the presumption of abandonment shall not arise until the final determination of all filed motions for. after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. once the period of delinquency is established, the redemption period shall be set on the following scale: Properties. Tennessee Tax Sale Redemption Period.

From www.youtube.com

Tennessee Land For Sale Redemption Ridge, Wayne Co., TN YouTube Tennessee Tax Sale Redemption Period for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. Owners must either redeem the property. Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. after the sale, there is a redemption period within one (1). Tennessee Tax Sale Redemption Period.

From www.signnow.com

Tennessee Sales Tax 20202024 Form Fill Out and Sign Printable PDF Tennessee Tax Sale Redemption Period the presumption of abandonment shall not arise until the final determination of all filed motions for. once the period of delinquency is established, the redemption period shall be set on the following scale: to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. Owners must. Tennessee Tax Sale Redemption Period.

From www.uslegalforms.com

Tennessee Quitclaim Deed Five Individuals to One Individual US Tennessee Tax Sale Redemption Period after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. Owners must either redeem the property. to redeem your home after the tax sale, you. Tennessee Tax Sale Redemption Period.

From www.newtaxdeductions.com

The latest changes in the tax law that will effect you. New Tax Tennessee Tax Sale Redemption Period Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. once the period of delinquency is established, the redemption period shall be set on the following scale: for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days.. Tennessee Tax Sale Redemption Period.

From sanjaytaxprozzz.blogspot.com

Vehicle Sales Tax In Memphis Tn Tennessee Tax Sale Redemption Period to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. Owners must either redeem the property. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. once the period of delinquency is established, the. Tennessee Tax Sale Redemption Period.

From www.uslegalforms.com

Order authorizing redemption US Legal Forms Tennessee Tax Sale Redemption Period for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. Properties purchased in a tax sale may be redeemed by the previous owner, the heirs. Tennessee Tax Sale Redemption Period.

From www.youtube.com

How the Sales Tax Works in Tennessee YouTube Tennessee Tax Sale Redemption Period to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. after the sale, there is a redemption period within one (1) year from the. Tennessee Tax Sale Redemption Period.

From nataazlindie.pages.dev

Tn Sales Tax Holiday 2024 Date Gelya Joletta Tennessee Tax Sale Redemption Period once the period of delinquency is established, the redemption period shall be set on the following scale: after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall. Tennessee Tax Sale Redemption Period.

From www.bluesmagazine.nl

Recensie Tennessee Redemption Tennessee Redemption Tennessee Tax Sale Redemption Period once the period of delinquency is established, the redemption period shall be set on the following scale: Owners must either redeem the property. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. to redeem your home after the tax sale, you must pay the proper. Tennessee Tax Sale Redemption Period.

From www.nashvillerealestatenow.com

5 Stages of Tennessee Foreclosures Tennessee Tax Sale Redemption Period Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. Owners must either redeem the property. once the period of delinquency is established, the redemption period shall be set on the following scale: the presumption of abandonment shall not arise until the final determination of all filed motions. Tennessee Tax Sale Redemption Period.

From www.youtube.com

Common Tennessee Sales Tax Exemptions YouTube Tennessee Tax Sale Redemption Period after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. Owners must either redeem the property. to redeem your home after the tax. Tennessee Tax Sale Redemption Period.

From www.formsbank.com

Instructions For The Preparation Of The Tennessee Sales And Use Tax Tennessee Tax Sale Redemption Period for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. the presumption of abandonment shall not arise until the final determination of all. Tennessee Tax Sale Redemption Period.

From www.pinterest.com

The United States of sales tax, in one map U.s. states, Red state, Map Tennessee Tax Sale Redemption Period after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. to redeem your home after the tax sale, you must pay the proper redemption amount and file a motion with the court. Owners must either redeem the property. the presumption of abandonment shall not. Tennessee Tax Sale Redemption Period.

From www.youtube.com

Using the Tennessee Sales Tax Resale Certificate YouTube Tennessee Tax Sale Redemption Period Owners must either redeem the property. once the period of delinquency is established, the redemption period shall be set on the following scale: after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. the presumption of abandonment shall not arise until the final determination. Tennessee Tax Sale Redemption Period.

From zamp.com

Ultimate Tennessee Sales Tax Guide Zamp Tennessee Tax Sale Redemption Period once the period of delinquency is established, the redemption period shall be set on the following scale: for all property for which a showing is made pursuant to subdivision (a)(2), the redemption period shall be thirty (30) days. Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or.. Tennessee Tax Sale Redemption Period.

From www.northwestregisteredagent.com

How to Get A Seller’s Permit in Tennessee Northwest Registered Agent Tennessee Tax Sale Redemption Period after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant to tennessee. the presumption of abandonment shall not arise until the final determination of all filed motions for. once the period of delinquency is established, the redemption period shall be set on the following scale: . Tennessee Tax Sale Redemption Period.

From itep.org

Tennessee Who Pays? 7th Edition ITEP Tennessee Tax Sale Redemption Period once the period of delinquency is established, the redemption period shall be set on the following scale: Properties purchased in a tax sale may be redeemed by the previous owner, the heirs of the previous owner, or. after the sale, there is a redemption period within one (1) year from the date of the order confirming sale pursuant. Tennessee Tax Sale Redemption Period.